Office Address

43-5-32, behind Municipal School,

Railway New Colony,

Visakhapatnam,

Andhra Pradesh 530016

We empower Companies and Individuals to achieve financial clarity with our tailored services, including bookkeeping support, accounting, business tax advisory, and dedicated controller and CFO solutions.

We provide expert accounting, income tax, GST, and advisory services for over two decades. Our team of dedicated professionals brings extensive experience and in-depth knowledge to every client engagement. We have proudly served more than 100 clients across diverse industries, offering tailored solutions that meet their unique business needs.

Our commitment to excellence is reflected in our personalized approach, where we focus on building long-term relationships with clients. We understand the complexities of modern business and are equipped to handle everything from compliance to strategic tax planning. With a strong focus on delivering quality service, we continue to be a trusted partner for individuals, SMEs, and larger organizations seeking reliable financial guidance.

Partner

Contact Us

+91 99662 16315

Of experience in Practice

Comprehensive Audit and Advisory Solutions Under One Roof

We keep your financial records accurate and up-to-date with services like ongoing bookkeeping, accounts receivable and payable management, and month-end close processes. Let us handle the details so you can focus on your business growth.

We provide comprehensive TDS and Income Tax services in India, ensuring timely and accurate compliance.

We provide expert GST advisory services to simplify compliance and optimize tax efficiency.

We have supported hundreds of clients — from individuals and proprietorships to firms, LLPs, and companies. This diverse experience has equipped us with deep knowledge and expertise across different entity types.

We specialize in managing Income Tax and GST litigation, offering expert representation and tailored resolution strategies. Our goal is to navigate complex legal matters efficiently, ensuring favorable outcomes for our clients.

We offer services related to tax and TDS on property sales, repatriation of funds, and tax on interest and rental income. Our expertise includes income tax filing, handling scrutiny notices, and tax planning for returning Indians.

We simplify company registration by handling structure selection, documentation, DIN/DSC, name reservation, and initial compliance to get your business started seamlessly.

We assist in obtaining essential licenses like GST Registration, Shop & Establishment License, Import Export Code (IEC), FSSAI License, EPF, and ESI to ensure your business operates smoothly and stays compliant.

Accurate and timely bookkeeping to manage your financial records, track expenses, and ensure compliance — giving you a clear picture of your business’s financial health.

Expert financial guidance on a monthly basis, including strategic planning, cash flow management, compliance oversight, and performance reporting — all tailored to drive growth and streamline operations.

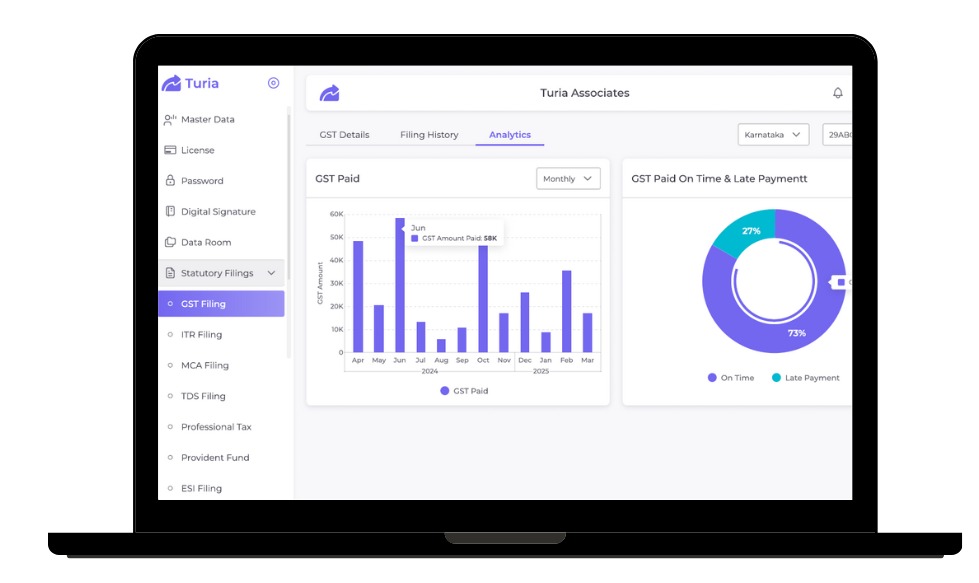

Access a comprehensive dashboard that tracks all your compliance history, providing real-time updates, reminders, and easy access to past filings to ensure you stay on top of all regulatory requirements.

Stay organized with our Compliance Calendar, which tracks all important filing dates, deadlines, and regulatory requirements, ensuring your business never misses a compliance step.

Receive timely alerts and notifications for upcoming compliance deadlines, filings, and regulatory requirements, helping you stay proactive and avoid penalties.

Access a comprehensive dashboard that tracks all your compliance history, providing real-time updates, reminders, and easy access to past filings to ensure you stay on top of all regulatory requirements.

Store and organize all compliance-related documents in a secure cloud-based repository.

43-5-32, behind Municipal School,

Railway New Colony,

Visakhapatnam,

Andhra Pradesh 530016

+91 99662 16315

gstrelief@gmail.com

Kindly send your enquries and we will respond within 24 hours.